Dividend Prediction with LSTM

Forecasting future dividends using a sequence model (LSTM) on historical market data. Built with a clean data pipeline, reliable modeling, and an interactive Tableau dashboard.

Data Pipeline

- Fetched price/dividend data via

yfinanceand unified it to a consistent datetime index. - Handled missing values and ensured sorted, aligned series per ticker.

- Prepared supervised sequences with a look-back window → next dividend format.

- Split data by time (train, validation, test) to prevent leakage.

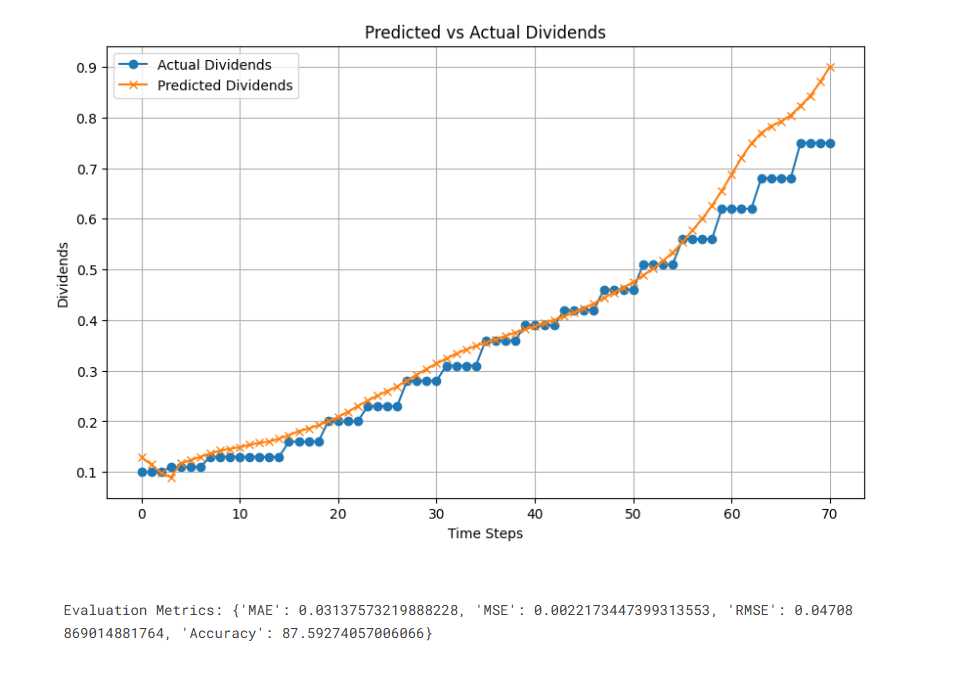

LSTM Model

- Implemented an LSTM in Keras to predict future dividends.

- Tuned hyperparameters with Adam optimizer and early stopping.

- Evaluated predictions on held-out time segments with clear visualizations.

Deployment

The trained model was deployed for reuse within my data pipeline, enabling reproducible inference and integration into visualizations.

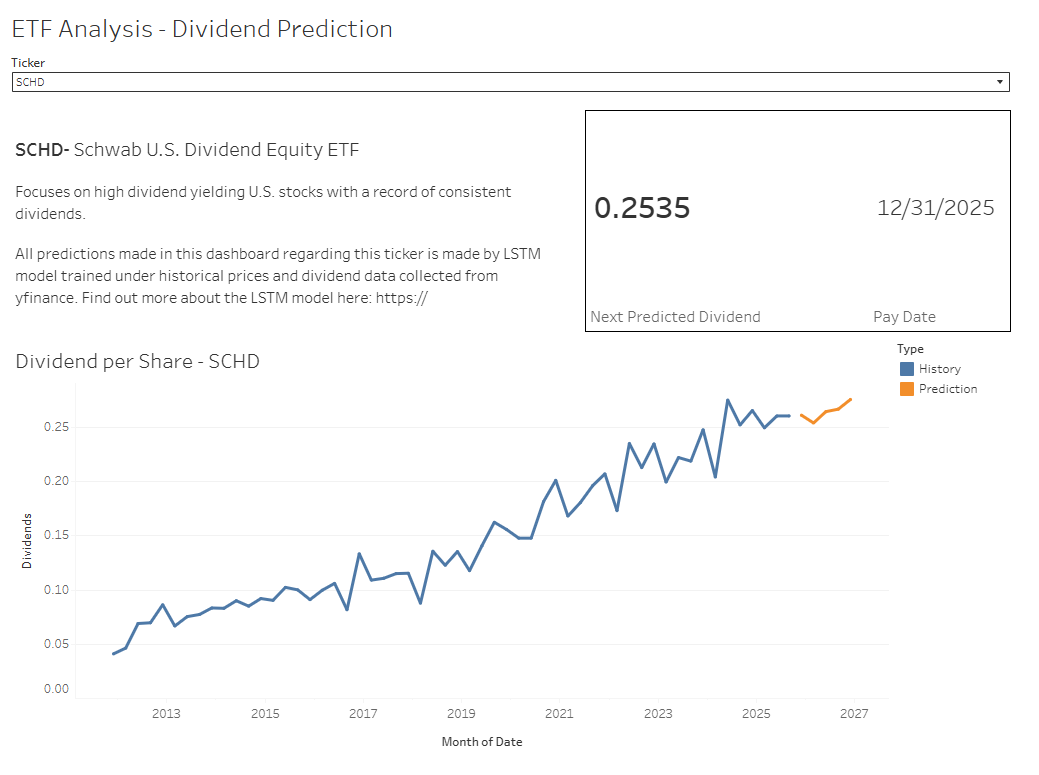

Tableau Dashboard

- Interactive ticker selection to explore multiple ETFs/stocks.

- KPIs: latest predicted dividend, year-over-year change, trailing 12-month totals.

- Timeline view overlaying historical and LSTM-predicted dividends.

- Dynamic filters and tooltips for exploring results.

- Export option for downloading filtered datasets.

Screenshots